This credit card payoff calculator is intended solely for general informational and educational purposes.If you have several cards with high interest rates, a lower rate could even help you more than paying off your smallest balance first. If you can’t pay more than the minimum on your card, see if you can find a balance transfer card that has a lower interest rate than the one you’re currently paying, because a lower interest rate will help you pay less by the time it’s paid off. A credit card payment calculator like this one can help you estimate how fast you can pay off debts if you pay more than the minimum each month. If you can, try to pay more than the minimum so you can lower your balance and pay less in interest over the life of the loan.

Many credit card issuers allow cardholders to carry a balance month-to-month and make “minimum payments” (usually around $25 or 3% of the total balance) partly for the cardholder’s convenience, but also because it benefits the issuer to create a big interest charge. Next, see if you can pay more than the minimum payment If you’re interested in learning more, check out our advice on Keeping Score. Both of these options will help raise your credit score in addition to relieving some of your debt. To save the most money in the long run, pay down the debt with the highest interest rate, or pay the debt that is closest to your credit max. If you have multiple credit cards, loans or other debts, it’s important to look at a few factors when deciding which to pay off first. First, choose which debt to pay off first Your actual savings may be different based on your purchase and payment activity as well as other fees. The savings shown in your results are based on the difference in total compound interest charges between the higher APR cards you entered and the lower promotional balance transfer APR, net of transfer fees. Once you’ve used our payoff calculator, there are some ways that you could use the results to inform your strategy so you pay your balance off faster and pay less in interest overall. We’ll even give you recommendations on cards that will help you save money. Just enter your current balance, APR, issuer and monthly payment to see how long it will take to pay off your balance and how much you’ll pay in interest. Pay It Down is a creative interactive tool that can be used by parents and educators to teach responsible money management.You’re closer to being debt-free than you think. Paying off existing debt is one of the best ways to save money, and seeing a graph that shows your debt going down is a great motivator. In today’s economy, people are looking for more ways to be smart about money.

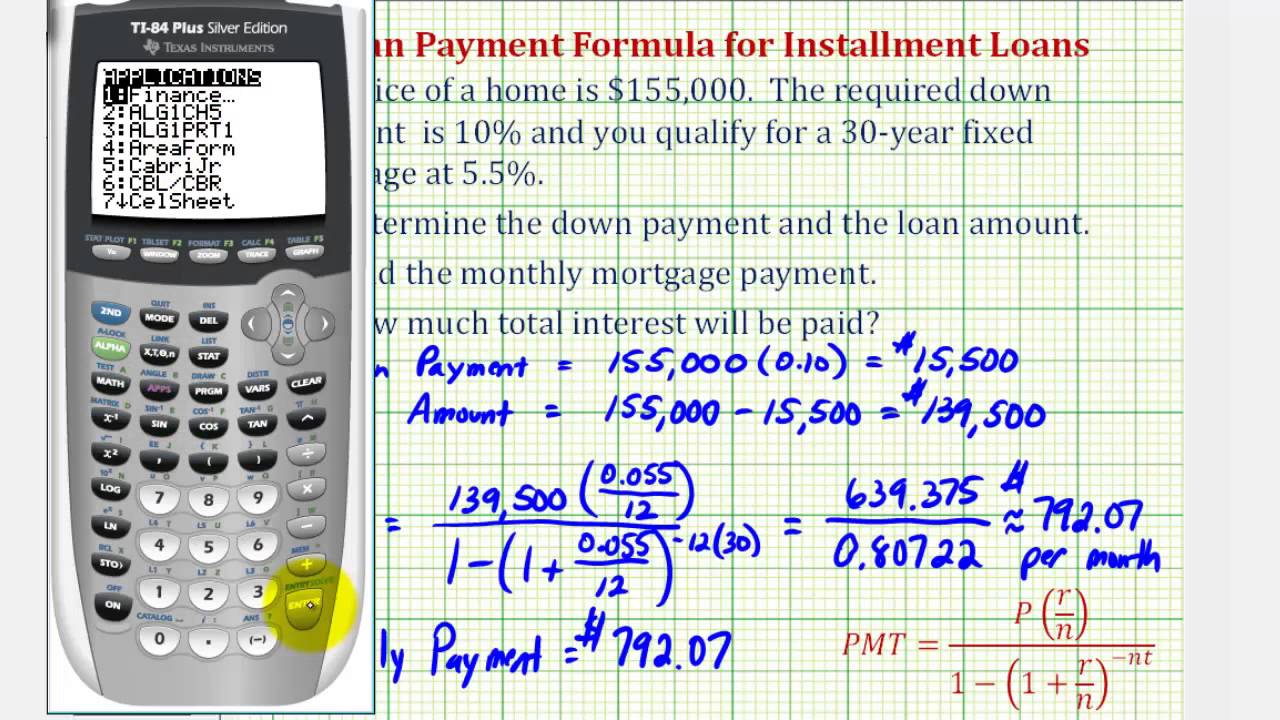

Just record the basic information for each loan, and Pay It Down will calculate the total interest and monthly payment – critical factors in determining which loan offer is a better deal. Or, use Pay It Down to compare two or more different loan offers before deciding which to sign up for. Use the Additional Payment Settings to see how adding a small amount to your monthly payment can shave months or even years off of your debt repayment plan. Use Pay It Down to determine the debt repayment time for a simple loan or credit card debt, or enter more information and Pay It Down will graph your total personal debt profile and calculate when you will be completely debt free. Pay It Down is an easy-to-use application that helps you calculate and visualize the best strategy for getting out of debt.

0 kommentar(er)

0 kommentar(er)